The Paducah Finance Department reminds property owners of the online option to view and pay real estate bills using a credit or debit card. The online option was launched in 2022.

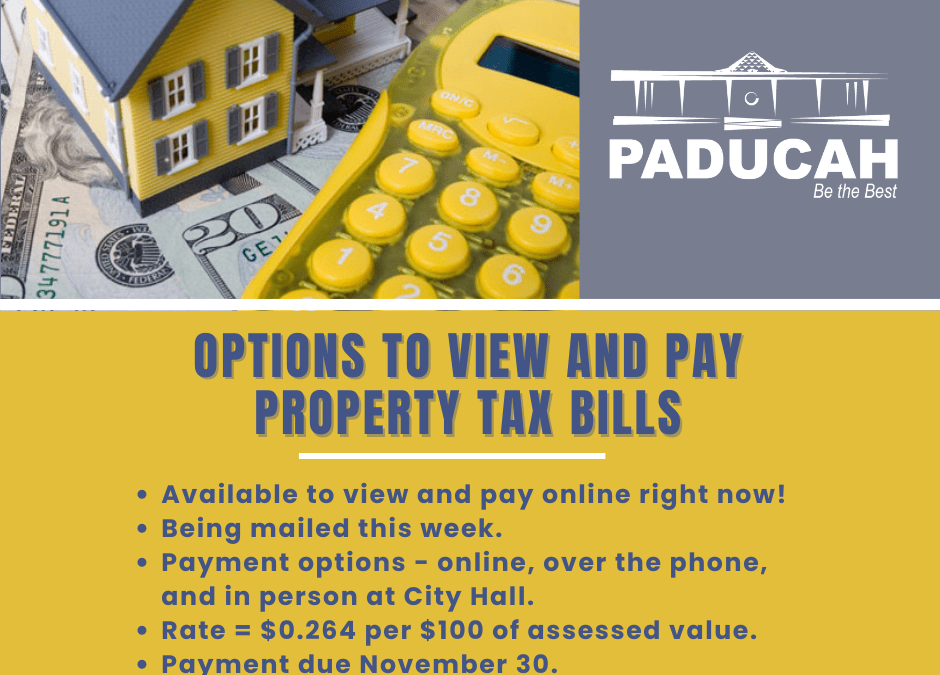

City of Paducah real estate bills are available for online payment at this time and are being mailed this week with payments due November 30 without penalty or interest. If a property owner does not receive the real estate tax bill by mid to late October, please email the Finance Department.

In addition to the online option, the City of Paducah accepts cash, check, credit, and debit card payments in person at City Hall located at 300 South 5th Street. Payments can be made over-the-phone as well by calling 270-444-8513. A 3.75 percent service charge will apply on credit and debit card payments. Payment types include Discover, MasterCard, and Visa. The City does not charge or retain this service charge. There is a $2.00 minimum per transaction.

New this year, the City is offering an Interactive Voice Response (IVR) System for the payment of property tax bills. This is a 24-hour service to pay property tax bills over the phone with a card or check without speaking to a finance agent. Services are offered in English and Spanish. A few additional notes are as follows:

- There is a service fee of $0.50 per transaction in addition to e-check and credit card processing fees.

- Real Estate Tax IVR – 833-256-9146 (please have bill year and bill number ready).

- Personal Property Tax IVR – 866-800-3584 (please have bill year and bill number ready).

In September, the Paducah Board of Commissioners voted to set Paducah’s property tax rate at 26.4 cents per $100 of assessed value.

Please note that the City government does NOT set the city or county school tax rates or assess a property’s value. Property owners will receive a separate bill from the McCracken County Sheriff for County government and other agencies.

Learn more by visiting Property Tax.